GAAP EPS of $0.57 – unchanged YoY; Non-GAAP EPS* increased to $0.67 from $0.62

Cash, cash equivalents, debt securities, and current equity investments totaled $177.6 million

Initiates quarterly dividend of $0.05 per share of Common Stock

NEWARK, NJ, March 06, 2024 — IDT Corporation (NYSE: IDT), a global provider of fintech, cloud communications, and traditional communications services, today reported results for the second quarter of its fiscal year 2024, the three months ended January 31, 2024.

HIGHLIGHTS

(Throughout this release, unless otherwise noted, results are for the second quarter of fiscal year 2024 (2Q24) and are compared to the second quarter of fiscal year 2023 (2Q23). All earnings per share (EPS) and other ‘per share’ results are per diluted share.)

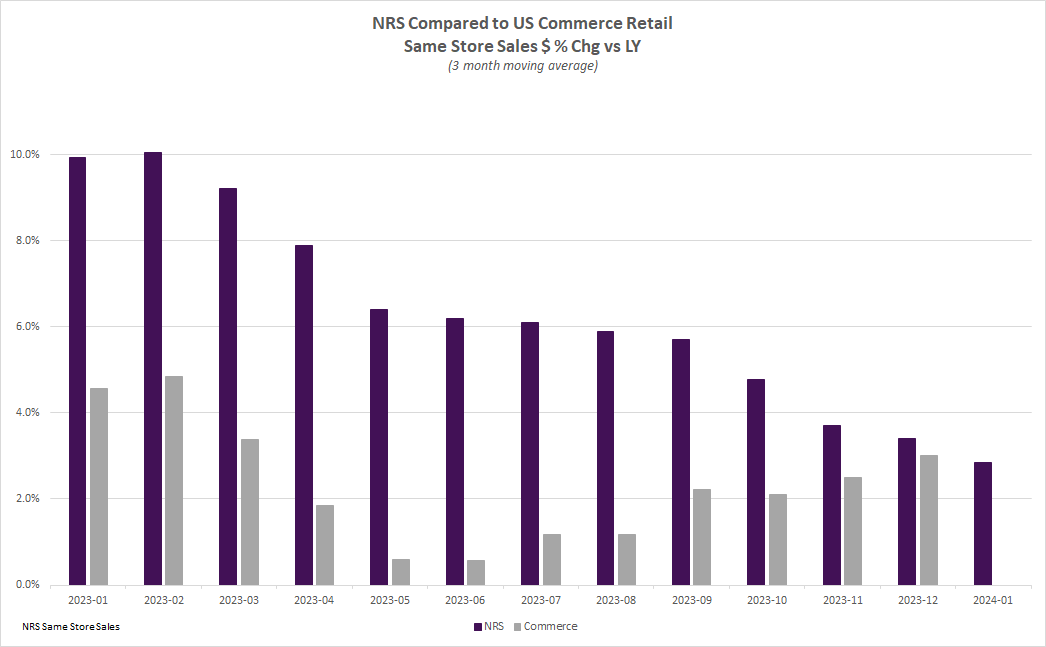

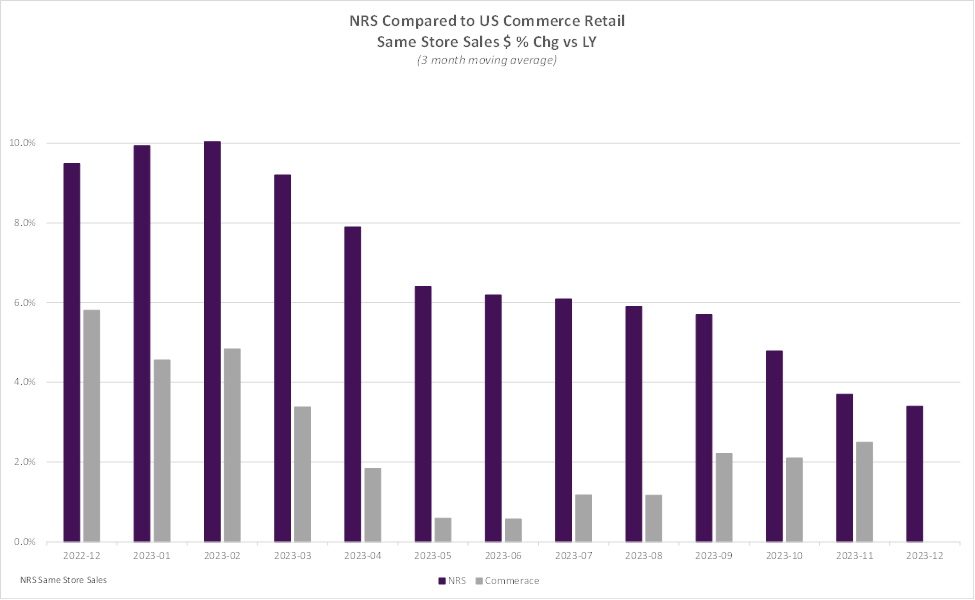

- National Retail Solutions (NRS) added approximately 1,500 net active point-of-sale (POS) terminals during 2Q24 to reach approximately 28,700 as of January 31st. NRS recurring revenue** increased 30% to $23.9 million;

- BOSS Money, the principal business in IDT’s Fintech segment, increased revenue 42% to $25.0 million while increasing remittance volume by 37% to 4.2 million transactions during 2Q24;

- net2phone added approximately 11,000 net seats served during 2Q24 to reach approximately 375,000 as of January 31st. Subscription revenue** increased 19% to $19.3 million. Income from operations increased to $0.4 million and Adjusted EBITDA* increased 126% to $1.8 million;

- Consolidated revenue decreased 6% to $296 million from $314 million;

- Consolidated gross profit*** increased 8% to a record $97 million from $90 million, and the consolidated gross profit margin increased 410 basis points to 32.9% from 28.8%;

- Consolidated income from operations decreased 12% to $16.0 million from $18.2 million;

- Net income attributable to IDT decreased slightly to $14.4 million from $14.6 million;

- Consolidated Adjusted EBITDA* decreased 7% to $21.8 million from $23.4 million;

- GAAP EPS was unchanged at $0.57 and Non-GAAP EPS* increased to $0.67 from $0.62.

- IDT’s Board of Directors has initiated a quarterly cash dividend of $0.05 per share of its Class A and Class B Common stock. The initial dividend will be paid on or about March 27th with a record date of March 19th.

(See ‘Notes’ later in this release for supplemental information on asterisked metrics).

REMARKS BY SHMUEL JONAS, CEO

“The second quarter was highlighted by the continued expansion of our growth businesses, with both NRS and BOSS Money surpassing the $100 million annual revenue run rate milestone.

“NRS continued to deliver robust recurring revenue per terminal. We again saw strong growth in Merchant Services and SaaS revenues, and increased Merchant Services revenue per NRS Pay account. We added approximately 1500 net new terminals to the NRS network this quarter.

“BOSS Money delivered another quarter of impressive results, with 42% year-over-year revenue growth. Its improving economics helped our Fintech segment to achieve Adjusted EBITDA break-even for the quarter.

“I am also very pleased with net2phone increasing subscription revenue 19% year over year and achieving cash flow break-even – which we measure as Adjusted EBITDA less CapEx. Together, our combined growth segments propelled IDT to achieve another quarter of record consolidated gross profit and increased gross margin.

“The businesses within our Traditional Communications segment continue to generate strong cash-flow. Over the past few months, we have been very focused on reducing our overhead and on streamlining our operations within Traditional Communications and company-wide. You will see the benefits of these efforts in the third quarter and beyond.

“Now, I want to provide some context to our Board’s decision to initiate a quarterly cash dividend.

“NRS, BOSS Money and net2phone no longer need new cash investments to fund their organic growth. In aggregate, they have become significant contributors to our bottom line. Meanwhile, we expect cash flows from our Traditional Communications segment to remain robust for years to come. The strength of our operational results and of our balance sheet — including our enhanced liquidity — provides us with flexibility as we invest in the development of our next generation of exciting early-stage initiatives and scout for other growth opportunities.

“In light of our robust financial position and positive outlook, the Board felt that we should supplement our ongoing program of opportunistic stock buybacks, which can vary from quarter to quarter, with a regular, predictable dividend payment to our stockholders.”

CONSOLIDATED RESULTS

| IDT Consolidated Results ($ in millions, except gross profit margin and EPS) |

|||||||

| 2Q24 | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 2Q24-2Q23 Variance | ||

| Revenue | $296.1 | $301.2 | $303.8 | $299.3 | $313.9 | (5.7)% | |

| Gross profit*** | $97.4 | $94.4 | $91.1 | $87.9 | $90.4 | +7.7% | |

| Gross profit margin | 32.9% | 31.4% | 30.0% | 29.4% | 28.8% | +410 bps | |

| SG&A | $80.7 | $77.2 | $78.2 | $72.6 | $72.1 | +12.0% | |

| Income from operations | $16.0 | $17.2 | $12.0 | $10.4 | $18.2 | (11.9)% | |

| Adjusted EBITDA* | $21.8 | $22.3 | $18.1 | $20.5 | $23.4 | (7.0)% | |

| Net income attributable to IDT | $14.4 | $7.7 | $8.0 | $6.9 | $14.6 | $(0.2) | |

| EPS (diluted) | $0.57 | $0.30 | $0.31 | $0.27 | $0.57 | NC | |

| Non-GAAP EPS* (diluted) | $0.67 | $0.32 | $0.36 | $0.46 | $0.62 | +$0.05 | |

RESULTS BY SEGMENT

National Retail Solutions (NRS)

During 2Q24 and 2Q23, the NRS segment contributed 8.5% and 6.3% of IDT’s consolidated revenue, respectively.

| National Retail Solutions (NRS) (Terminals and accounts at end of period. $ in millions, except for revenue per terminal) |

||||||||||||||

| 2Q24 | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 2Q24-2Q23 Variance | |||||||||

| Terminals and payment processing accounts | ||||||||||||||

| Active POS terminals | 28,700 | 27,200 | 25,700 | 23,900 | 22,400 | +28.5 | % | |||||||

| Payment processing accounts | 18,200 | 17,100 | 15,800 | 14,100 | 12,500 | +45.2 | % | |||||||

| Recurring revenue | ||||||||||||||

| Merchant Services and other | $ | 12.5 | $ | 11.4 | $ | 10.3 | $ | 8.7 | $ | 7.4 | +68.1 | % | ||

| Advertising & Data | $ | 8.7 | $ | 8.5 | $ | 6.2 | $ | 5.8 | $ | 9.0 | (3.0 | )% | ||

| SaaS Fees | $ | 2.7 | $ | 2.5 | $ | 2.3 | $ | 2.1 | $ | 1.9 | +40.0 | % | ||

| Total recurring revenue | $ | 23.9 | $ | 22.4 | $ | 18.8 | $ | 16.5 | $ | 18.3 | +30.4 | % | ||

| POS Terminal Sales | $ | 1.3 | $ | 1.6 | $ | 1.1 | $ | 1.6 | $ | 1.5 | (11.3 | )% | ||

| Total revenue | $ | 25.2 | $ | 24.0 | $ | 19.9 | $ | 18.1 | $ | 19.8 | +27.2 | % | ||

| Monthly average recurring revenue per terminal** | $ | 285 | $ | 282 | $ | 253 | $ | 237 | $ | 283 | +0.7 | % | ||

| Gross profit | $ | 22.6 | $ | 20.9 | $ | 17.4 | $ | 15.1 | $ | 17.2 | +31.0 | % | ||

| SG&A | $ | 17.2 | $ | 15.4 | $ | 15.6 | $ | 13.0 | $ | 11.9 | +45.3 | % | ||

| Income from operations | $ | 5.3 | $ | 5.5 | $ | 1.7 | $ | 2.1 | $ | 5.4 | (0.5 | )% | ||

| Adjusted EBITDA* | $ | 6.1 | $ | 6.2 | $ | 2.4 | $ | 2.7 | $ | 6.0 | +2.7 | % | ||

Take-Aways:

- During 2Q24, NRS added approximately 1,500 net active terminals to reach approximately 28,700 and added approximately 1,100 net payment processing accounts to reach approximately 18,200.

- The 68% year-over-year increase in Merchant Services and other revenue reflects both the increases in payment processing accounts and merchant services revenue per payment processing account.

- Monthly average recurring revenue per terminal** increased slightly year-over-year reflecting the increases in Merchant Services and other and SaaS Fees revenues per terminal.

net2phone

During 2Q24 and 2Q23, the net2phone segment contributed 6.9% and 5.7% of IDT’s consolidated revenue, respectively.

| net2phone (Seats in thousands at end of period. $ in millions) |

|||||||

| 2Q24 | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 2Q24-2Q23 Variance | ||

| Seats | 375 | 364 | 352 | 340 | 327 | +14.7% | |

| Revenue | |||||||

| Subscription revenue** | $19.3 | $18.5 | $17.9 | $17.1 | $16.3 | +18.5% | |

| Other revenue | $1.0 | $1.4 | $1.4 | $1.3 | $1.5 | (30.7)% | |

| Total Revenue | $20.4 | $19.9 | $19.3 | $18.4 | $17.8 | +14.4% | |

| Gross profit | $16.4 | $16.1 | $15.5 | $14.8 | $14.2 | +15.4% | |

| SG&A | $16.1 | $16.1 | $16.1 | $15.2 | $14.8 | +8.9% | |

| Income (loss) from operations | $0.4 | $0.0 | $(0.7) | $(0.4) | $(0.6) | +$0.9 | |

| Adjusted EBITDA* | $1.8 | $1.4 | $0.9 | $1.0 | $0.8 | +$1.0 | |

Take-Aways:

- Contact center as a service (CCaaS) seats served increased 23% year-over-year to approximately 11,000.

- net2phone’s sequential and year-over-year increases in unified communications as a service (UCaaS) seats served were powered by continued expansion in key markets led by the U.S., Brazil, and Mexico.

- The 18.5% increase in subscription revenue was driven by an increase in seats served augmented by an increase in average recurring revenue per seat (ARPU). The ARPU increase reflects, in part, the faster rate of CCaaS seat expansion compared to UCaaS seats.

Fintech

During 2Q24 and 2Q23, the Fintech segment contributed 9.4% and 6.5% of IDT’s consolidated revenue, respectively.

| Fintech (Transactions in millions. $ in millions except for revenue per transaction) |

|||||||

| 2Q24 | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 2Q24-2Q23 Variance | ||

| BOSS Money Transactions | 4.2 | 4.0 | 3.8 | 3.3 | 3.1 | +37.1% | |

| Fintech Revenue | |||||||

| BOSS Money | $25.0 | $24.2 | $22.3 | $19.4 | $17.6 | +41.9% | |

| Other | $2.9 | $2.3 | $2.3 | $2.3 | $2.7 | +10.3% | |

| Total Revenue | $28.0 | $26.6 | $24.6 | $21.8 | $20.3 | +37.7% | |

| Average revenue per transaction** | $5.98 | $5.99 | $5.87 | $5.94 | $5.78 | +3.5% | |

| Gross profit | $16.1 | $14.8 | $13.6 | $12.6 | $12.3 | +31.1% | |

| SG&A | $16.8 | $16.2 | $15.5 | $13.9 | $13.4 | +25.3% | |

| Loss from operations | $(0.7) | $(1.4) | $(1.9) | $(1.3) | $(0.8) | +$0.1 | |

| Adjusted EBITDA* | $0.0 | $(0.7) | $(1.2) | $(0.6) | $(0.5) | +$0.5 | |

Take-Aways:

- The 37% year-over-year increase in BOSS Money transactions comprised a 36% increase in digital transactions and a 43% increase in retail transactions. The latter was driven by expansion of the BOSS Money retail agent network.

- BOSS Money revenue increased 42% driven primarily by cross-marketing within the larger BOSS ecosystem, an expansion of the BOSS Money retailer network, and ongoing efforts to enhance user-experience within the BOSS Money and Boss Calling apps.

- The continued growth of BOSS Money transaction volumes and improving unit economics drove the Fintech segment’s year-over-year and sequential improvements in loss from operations and Adjusted EBITDA.

Traditional Communications

During 2Q24 and 2Q23, the Traditional Communications segment contributed 75.2% and 81.5% of IDT’s consolidated revenue, respectively.

| Traditional Communications ($ in millions) |

|||||||||||||

| 2Q24 | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 2Q24-2Q23 Variance | ||||||||

| Revenue | |||||||||||||

| IDT Digital Payments | $ | 99.6 | $ | 100.0 | $ | 100.8 | $ | 101.0 | $ | 106.1 | (6.1 | )% | |

| BOSS Revolution Calling | $ | 66.7 | $ | 71.2 | $ | 75.4 | $ | 77.6 | $ | 82.8 | (19.5 | )% | |

| IDT Global | $ | 48.7 | $ | 52.0 | $ | 55.6 | $ | 54.5 | $ | 58.6 | (16.9 | )% | |

| Other | $ | 7.5 | $ | 7.5 | $ | 8.2 | $ | 7.9 | $ | 8.4 | (11.2 | )% | |

| Total Revenue | $ | 222.5 | $ | 230.7 | $ | 240.0 | $ | 241.0 | $ | 256.0 | (13.1 | )% | |

| Gross profit | $ | 42.3 | $ | 42.6 | $ | 44.7 | $ | 45.4 | $ | 46.7 | (9.4 | )% | |

| SG&A | $ | 27.3 | $ | 26.6 | $ | 28.4 | $ | 28.2 | $ | 29.5 | (7.3 | )% | |

| Income from operations | $ | 14.6 | $ | 15.4 | $ | 14.1 | $ | 12.9 | $ | 17.0 | (14.0 | )% | |

| Adjusted EBITDA* | $ | 17.0 | $ | 18.1 | $ | 18.6 | $ | 19.7 | $ | 19.6 | (13.2 | )% | |

Take-Aways:

- As in recent prior quarters, the year-over-year decrease in IDT Digital Payments’ revenue was due to the deterioration of a key international mobile top-up corridor. By 1Q24, however, that corridor was no longer a significant factor in current results

- Traditional Communications revenue continued to decrease in line with expectations while the segment’s gross profits have been comparatively more durable.

- IDT continues to streamline the operations of its Boss Revolution and IDT Global businesses and expects this effort will drive reductions in SG&A in the coming quarters.

OTHER FINANCIAL RESULTS

Consolidated results for all periods presented include corporate overhead. Corporate G&A expense increased to $3.2 million in 2Q24 from $2.5 million in 2Q23 reflecting an increase in employee compensation expense.

As of January 31, 2024, IDT held $177.6 million in cash, cash equivalents, debt securities, and current equity investments. Current assets totaled $407.6 million and current liabilities totaled $285.0 million. IDT had no outstanding debt at the fiscal quarter’s end.

Net cash provided by operating activities during 2Q24 was $24.9 million – an increase from $17.4 million during 2Q23. Exclusive of changes in customer deposit balances at IDT’s Gibraltar-based bank, net cash provided by operating activities increased slightly to $20.4 million from $20.3 million during 2Q23.

Capital expenditures decreased to $4.6 million in 2Q24 from $5.4 million in 2Q23.

IDT EARNINGS ANNOUNCEMENT INFORMATION

This release is available for download in the “Investors & Media” section of the IDT Corporation website (https://www.idt.net/investors-and-media) and has been filed on a current report (Form 8-K) with the SEC.

IDT will host an earnings conference call beginning at 5:30 PM Eastern today with management’s discussion of results followed by Q&A with investors. To listen to the call and participate in the Q&A, dial 1-877-545-0523 (toll-free from the US) or 1-973-528-0016 (international) and request the IDT Corporation call (participant access code: 918160).

A replay of the conference call will be available approximately three hours after the call concludes through Wednesday, March 20, 2024. To access the call replay, dial 1-877-481-4010 (toll-free from the US) or 1-919-882-2331 (international) and provide this replay passcode: 49825. The replay will also be accessible via streaming audio at the IDT investor relations website.

NOTES

*Adjusted EBITDA and Non-GAAP EPS are Non-GAAP financial measures intended to provide useful information that supplements IDT’s or the relevant segment’s results in accordance with GAAP. Please refer to the Reconciliation of Non-GAAP Financial Measures later in this release for an explanation of these terms and their respective reconciliations to the most directly comparable GAAP measures.

**See ‘Explanation of Key Performance Metrics’ at the end of this release.

*** IDT now includes depreciation and amortization expense in direct cost of revenues or SG&A expense, as appropriate, and reports gross profit and gross margin in accordance with GAAP. Results for all prior periods presented have been reclassified to conform to the current period’s presentation.

ABOUT IDT CORPORATION

IDT Corporation (NYSE: IDT) is a global provider of fintech and communications services through a portfolio of synergistic businesses: National Retail Solutions (NRS), through its point-of-sale (POS) platform, enables independent retailers to operate more effectively while providing advertisers and marketers with unprecedented reach into underserved consumer markets; net2phone provides enterprises and organizations with intelligently integrated cloud communications and contact center services across channels and devices; IDT’s fintech and neo-banking services include BOSS Money, a popular international remittance business, as well as other services that make saving, spending, and sharing money easy and secure; IDT Digital Payments and BOSS Revolution Calling make sharing prepaid products and services and speaking with friends and family around the world convenient and reliable; and, IDT Global and IDT Express enable communications services to provision and manage international voice and SMS messaging.

All statements above that are not purely about historical facts, including, but not limited to, those in which we use the words “believe,” “anticipate,” “expect,” “plan,” “intend,” “estimate,” “target” and similar expressions, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. While these forward-looking statements represent our current judgment of what may happen in the future, actual results may differ materially from the results expressed or implied by these statements due to numerous important factors. Our filings with the SEC provide detailed information on such statements and risks and should be consulted along with this release. To the extent permitted under applicable law, IDT assumes no obligation to update any forward-looking statements.

CONTACT

IDT Corporation Investor Relations

Bill Ulrey

william.ulrey@idt.net

973-438-3838

IDT CORPORATION

CONSOLIDATED BALANCE SHEETS

| January 31, 2024 |

July 31, 2023 |

|||||||

| (Unaudited) | ||||||||

| (in thousands, except per share data) | ||||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 141,081 | $ | 103,637 | ||||

| Restricted cash and cash equivalents | 93,231 | 95,186 | ||||||

| Debt securities | 31,419 | 42,414 | ||||||

| Equity investments | 5,076 | 6,198 | ||||||

| Trade accounts receivable, net of allowance for credit losses of $6,315 at January 31, 2024 and allowance for doubtful accounts of $5,642 at July 31, 2023 | 37,392 | 32,092 | ||||||

| Settlement assets, net of reserve of $1,514 at January 31, 2024 and $1,143 at July 31, 2023 | 17,200 | 32,396 | ||||||

| Disbursement prefunding | 27,749 | 30,113 | ||||||

| Prepaid expenses | 23,523 | 16,638 | ||||||

| Other current assets | 30,905 | 28,394 | ||||||

| Total current assets | 407,576 | 387,068 | ||||||

| Property, plant, and equipment, net | 38,713 | 38,655 | ||||||

| Goodwill | 26,318 | 26,457 | ||||||

| Other intangibles, net | 7,026 | 8,196 | ||||||

| Equity investments | 7,558 | 9,874 | ||||||

| Operating lease right-of-use assets | 5,079 | 5,540 | ||||||

| Deferred income tax assets, net | 18,313 | 24,101 | ||||||

| Other assets | 11,195 | 10,919 | ||||||

| Total assets | $ | 521,778 | $ | 510,810 | ||||

| Liabilities, redeemable noncontrolling interest, and equity | ||||||||

| Current liabilities: | ||||||||

| Trade accounts payable | $ | 21,514 | $ | 22,231 | ||||

| Accrued expenses | 107,181 | 110,796 | ||||||

| Deferred revenue | 33,803 | 35,343 | ||||||

| Customer deposits | 87,553 | 86,481 | ||||||

| Settlement liabilities | 15,789 | 21,495 | ||||||

| Other current liabilities | 19,194 | 17,761 | ||||||

| Total current liabilities | 285,034 | 294,107 | ||||||

| Operating lease liabilities | 2,448 | 2,881 | ||||||

| Other liabilities | 3,716 | 3,354 | ||||||

| Total liabilities | 291,198 | 300,342 | ||||||

| Commitments and contingencies | ||||||||

| Redeemable noncontrolling interest | 10,693 | 10,472 | ||||||

| Equity: | ||||||||

| IDT Corporation stockholders’ equity: | ||||||||

| Preferred stock, $.01 par value; authorized shares-10,000; no shares issued | – | – | ||||||

| Class A common stock, $.01 par value; authorized shares-35,000; 3,272 shares issued and 1,574 shares outstanding at January 31, 2024 and July 31, 2023 | 33 | 33 | ||||||

| Class B common stock, $.01 par value; authorized shares-200,000; 28,069 and 27,851 shares issued and 23,781 and 23,699 shares outstanding at January 31, 2024 and July 31, 2023, respectively | 281 | 279 | ||||||

| Additional paid-in capital | 300,631 | 301,408 | ||||||

| Treasury stock, at cost, consisting of 1,698 and 1,698 shares of Class A common stock and 4,288 and 4,152 shares of Class B common stock at January 31, 2024 and July 31, 2023, respectively | (118,631 | ) | (115,461 | ) | ||||

| Accumulated other comprehensive loss | (17,276 | ) | (17,192 | ) | ||||

| Retained earnings | 46,746 | 24,662 | ||||||

| Total IDT Corporation stockholders’ equity | 211,784 | 193,729 | ||||||

| Noncontrolling interests | 8,103 | 6,267 | ||||||

| Total equity | 219,887 | 199,996 | ||||||

| Total liabilities, redeemable noncontrolling interest, and equity | $ | 521,778 | $ | 510,810 | ||||

IDT CORPORATION

CONSOLIDATED STATEMENTS OF INCOME

(Unaudited)

| Three Months Ended January 31, |

Six Months Ended January 31, |

|||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| (in thousands, except per share data) | ||||||||||||||||

| Revenues | $ | 296,098 | $ | 313,936 | $ | 597,302 | $ | 635,752 | ||||||||

| Direct cost of revenues | 198,699 | 223,499 | 405,475 | 456,170 | ||||||||||||

| Gross profit | 97,399 | 90,437 | 191,827 | 179,582 | ||||||||||||

| Operating expenses (gains): | ||||||||||||||||

| Selling, general and administrative (i) | 80,743 | 72,060 | 157,965 | 141,679 | ||||||||||||

| Severance | 345 | 213 | 869 | 312 | ||||||||||||

| Other operating expense (gain), net | 294 | (17 | ) | (190 | ) | (816 | ) | |||||||||

| Total operating expenses | 81,382 | 72,256 | 158,644 | 141,175 | ||||||||||||

| Income from operations | 16,017 | 18,181 | 33,183 | 38,407 | ||||||||||||

| Interest income, net | 1,195 | 810 | 2,039 | 1,320 | ||||||||||||

| Other income (expense), net | 2,534 | 1,613 | (3,053 | ) | (2,229 | ) | ||||||||||

| Income before income taxes | 19,746 | 20,604 | 32,169 | 37,498 | ||||||||||||

| Provision for income taxes | (3,992 | ) | (5,295 | ) | (7,939 | ) | (9,634 | ) | ||||||||

| Net income | 15,754 | 15,309 | 24,230 | 27,864 | ||||||||||||

| Net income attributable to noncontrolling interests | (1,329 | ) | (686 | ) | (2,146 | ) | (2,239 | ) | ||||||||

| Net income attributable to IDT Corporation | $ | 14,425 | $ | 14,623 | $ | 22,084 | $ | 25,625 | ||||||||

| Earnings per share attributable to IDT Corporation common stockholders: | ||||||||||||||||

| Basic | $ | 0.57 | $ | 0.57 | $ | 0.88 | $ | 1.00 | ||||||||

| Diluted | $ | 0.57 | $ | 0.57 | $ | 0.87 | $ | 1.00 | ||||||||

| Weighted-average number of shares used in calculation of earnings per share: | ||||||||||||||||

| Basic | 25,175 | 25,510 | 25,176 | 25,556 | ||||||||||||

| Diluted | 25,317 | 25,538 | 25,297 | 25,577 | ||||||||||||

| (i) Stock-based compensation included in selling, general and administrative expenses | $ | 2,487 | $ | 1,286 | $ | 3,258 | $ | 1,858 | ||||||||

IDT CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

| Six Months Ended January 31, |

||||||||

| 2024 | 2023 | |||||||

| (in thousands) | ||||||||

| Operating activities | ||||||||

| Net income | $ | 24,230 | $ | 27,864 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

| Depreciation and amortization | 10,146 | 9,801 | ||||||

| Deferred income taxes | 5,787 | 7,788 | ||||||

| Provision for credit losses, doubtful accounts receivable, and reserve for settlement assets | 1,696 | 915 | ||||||

| Net unrealized loss from marketable securities | 1,234 | 2,349 | ||||||

| Stock-based compensation | 3,258 | 1,858 | ||||||

| Other | 1,595 | 1,359 | ||||||

| Change in assets and liabilities: | ||||||||

| Trade accounts receivable | (7,040 | ) | 2,483 | |||||

| Settlement assets, disbursement prefunding, prepaid expenses, other current assets, and other assets | 9,966 | 2,323 | ||||||

| Trade accounts payable, accrued expenses, settlement liabilities, other current liabilities, and other liabilities | (12,021 | ) | (19,344 | ) | ||||

| Customer deposits at IDT Financial Services Limited (Gibraltar-based bank) | 2,253 | 15 | ||||||

| Deferred revenue | (1,381 | ) | (1,795 | ) | ||||

| Net cash provided by operating activities | 39,723 | 35,616 | ||||||

| Investing activities | ||||||||

| Capital expenditures | (8,885 | ) | (10,578 | ) | ||||

| Purchase of convertible preferred stock in equity method investment | (1,009 | ) | – | |||||

| Payments for acquisition | (60 | ) | – | |||||

| Purchases of debt securities and equity investments | (19,357 | ) | (28,129 | ) | ||||

| Proceeds from maturities and sales of debt securities and redemptions of equity investments | 31,231 | 27,531 | ||||||

| Net cash provided by (used in) investing activities | 1,920 | (11,176 | ) | |||||

| Financing activities | ||||||||

| Distributions to noncontrolling interests | (59 | ) | (187 | ) | ||||

| Proceeds from other liabilities | 100 | 300 | ||||||

| Repayment of other liabilities. | (15 | ) | (2,014 | ) | ||||

| Proceeds from borrowings under revolving credit facility | 30,588 | 2,383 | ||||||

| Repayment of borrowings under revolving credit facility. | (30,588 | ) | (2,383 | ) | ||||

| Proceeds from exercise of stock options | 172 | 172 | ||||||

| Repurchases of Class B common stock | (3,170 | ) | (5,341 | ) | ||||

| Net cash used in financing activities | (2,972 | ) | (7,070 | ) | ||||

| Effect of exchange rate changes on cash, cash equivalents, and restricted cash and cash equivalents | (3,182 | ) | 746 | |||||

| Net increase in cash, cash equivalents, and restricted cash and cash equivalents | 35,489 | 18,116 | ||||||

| Cash, cash equivalents, and restricted cash and cash equivalents at beginning of period | 198,823 | 189,562 | ||||||

| Cash, cash equivalents, and restricted cash and cash equivalents at end of period | $ | 234,312 | $ | 207,678 | ||||

| Supplemental schedule of non-cash financing activities | ||||||||

| Restricted net2phone common stock withheld from employees for income tax obligations | $ | 3,558 | $ | – | ||||

| Value of Class B common stock exchanged for NRS shares | $ | 6,254 | $ | – | ||||

| Stock issued to certain executive officers for bonus payments | $ | – | $ | 615 | ||||

*Reconciliation of Non-GAAP Financial Measures for the

Second Quarter Fiscal 2024 and 2023

In addition to disclosing financial results that are determined in accordance with generally accepted accounting principles in the United States of America (GAAP), IDT also disclosed for 2Q24, 1Q24, 4Q23, 3Q23, and 2Q23 Adjusted EBITDA and non-GAAP earnings per diluted share (EPS), both of which are non-GAAP measures.

Generally, a non-GAAP measure is a numerical measure of a company’s performance, financial position, or cash flows that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP.

IDT’s measure of non-GAAP EPS is calculated by dividing non-GAAP net income by the diluted weighted-average shares. IDT’s measure of non-GAAP net income starts with net income attributable to IDT in accordance with GAAP and adds severance expense, stock-based compensation, and other operating expense, and deducts other operating gains. These additions and subtractions are non-cash and/or non-routine items in the relevant fiscal 2024 and fiscal 2023 periods.

Management believes that IDT’s Adjusted EBITDA and non-GAAP EPS are measures which provide useful information to both management and investors by excluding certain expenses and non-routine gains and losses that may not be indicative of IDT’s or the relevant segment’s core operating results. Management uses Adjusted EBITDA, among other measures, as a relevant indicator of core operational strengths in its financial and operational decision making. In addition, management uses Adjusted EBITDA and non-GAAP EPS to evaluate operating performance in relation to IDT’s competitors. Disclosure of these financial measures may be useful to investors in evaluating performance and allows for greater transparency to the underlying supplemental information used by management in its financial and operational decision-making. In addition, IDT has historically reported similar financial measures and believes such measures are commonly used by readers of financial information in assessing performance, therefore the inclusion of comparative numbers provides consistency in financial reporting.

Management refers to Adjusted EBITDA, as well as the GAAP measures income (loss) from operations and net income, on a segment and/or consolidated level to facilitate internal and external comparisons to the segments’ and IDT’s historical operating results, in making operating decisions, for budget and planning purposes, and to form the basis upon which management is compensated.

While depreciation and amortization are considered operating costs under GAAP, these expenses primarily represent the non-cash current period allocation of costs associated with long-lived assets acquired or capitalized in prior periods. IDT’s Adjusted EBITDA, which is exclusive of depreciation and amortization, is a useful indicator of its current performance.

Severance expense is excluded from the calculation of Adjusted EBITDA and non-GAAP EPS. Severance expense is reflective of decisions made by management in each period regarding the aspects of IDT’s and its segments’ businesses to be focused on in light of changing market realities and other factors. While there may be similar charges in other periods, the nature and magnitude of these charges can fluctuate markedly and do not reflect the performance of IDT’s core and continuing operations.

Other operating (expense) gain, net, which is a component of income (loss) from operations, is excluded from the calculation of Adjusted EBITDA and non-GAAP EPS. Other operating (expense) gain, net includes, among other items, legal fees net of insurance claims related to Straight Path Communications Inc.’s stockholders’ class action, gains from the write-off of contingent consideration liabilities, gain from the sale of state income tax credits, and fixed asset write-offs. From time-to-time, IDT may have gains or incur costs related to non-routine legal, tax, and other matters, however, these various items generally do not occur each quarter. IDT believes the gain and losses from these non-routine matters are not components of IDT’s or the relevant segment’s core operating results.

Stock-based compensation recognized by IDT and other companies may not be comparable because of the variety of types of awards as well as the various valuation methodologies and subjective assumptions that are permitted under GAAP. Stock-based compensation is excluded from IDT’s calculation of non-GAAP EPS because management believes this allows investors to make more meaningful comparisons of the operating results per share of IDT’s core business with the results of other companies. However, stock-based compensation will continue to be a significant expense for IDT for the foreseeable future and an important part of employees’ compensation that impacts their performance.

Adjusted EBITDA and non-GAAP EPS should be considered in addition to, not as a substitute for, or superior to, income (loss) from operations, cash flow from operating activities, net income, basic and diluted earnings per share or other measures of liquidity and financial performance prepared in accordance with GAAP. In addition, IDT’s measurements of Adjusted EBITDA and non-GAAP EPS may not be comparable to similarly titled measures reported by other companies.

Following are reconciliations of Adjusted EBITDA and non-GAAP EPS to the most directly comparable GAAP measure, which are, (a) for Adjusted EBITDA, income (loss) from operations for IDT’s reportable segments and net income for IDT on a consolidated basis, and (b) for non-GAAP EPS, diluted earnings per share.

IDT Corporation

Reconciliation of Net Income to Adjusted EBITDA

(unaudited) in millions. Figures may not foot or cross-foot due to rounding to millions

| Total IDT Corporation | Traditional Communica-tions | net2phone | NRS | Fintech | Corporate | |||||||||||||||||||

| Three Months Ended January 31, 2024 (2Q24) |

||||||||||||||||||||||||

| Net income attributable to IDT Corporation | $ | 14.4 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||

| Net income attributable to noncontrolling interests | 1.3 | |||||||||||||||||||||||

| Net income | 15.8 | |||||||||||||||||||||||

| Provision for income taxes | 4.0 | |||||||||||||||||||||||

| Income before income taxes | 19.7 | |||||||||||||||||||||||

| Interest income, net | (1.2 | ) | ||||||||||||||||||||||

| Other income, net | (2.5 | ) | ||||||||||||||||||||||

| Income (loss) from operations | 16.0 | $ | 14.6 | $ | 0.4 | $ | 5.3 | $ | (0.7 | ) | $ | (3.6 | ) | |||||||||||

| Depreciation and amortization | 5.1 | 2.0 | 1.6 | 0.8 | 0.7 | – | ||||||||||||||||||

| Severance | 0.3 | 0.3 | – | – | – | – | ||||||||||||||||||

| Other operating expense (gain), net | 0.3 | – | (0.1 | ) | – | – | 0.4 | |||||||||||||||||

| Adjusted EBITDA | $ | 21.8 | $ | 17.0 | $ | 1.8 | $ | 6.1 | $ | – | $ | (3.2 | ) | |||||||||||

IDT Corporation

Reconciliation of Net Income to Adjusted EBITDA

(unaudited) in millions. Figures may not foot or cross-foot due to rounding to millions

| Total IDT Corporation | Traditional Communica-tions | net2phone | NRS | Fintech | Corporate | |||||||||||||||||||

| Three Months Ended October 31, 2023 (1Q24) |

||||||||||||||||||||||||

| Net income attributable to IDT Corporation | $ | 7.7 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||

| Net income attributable to noncontrolling interests | 0.8 | |||||||||||||||||||||||

| Net income | 8.5 | |||||||||||||||||||||||

| Provision for income taxes | 3.9 | |||||||||||||||||||||||

| Income before income taxes | 12.4 | |||||||||||||||||||||||

| Interest income, net | (0.8 | ) | ||||||||||||||||||||||

| Other expense, net | 5.6 | |||||||||||||||||||||||

| Income (loss) from operations | 17.2 | $ | 15.4 | $ | – | $ | 5.5 | $ | (1.4 | ) | $ | (2.3 | ) | |||||||||||

| Depreciation and amortization | 5.0 | 2.1 | 1.4 | 0.7 | 0.7 | – | ||||||||||||||||||

| Severance | 0.5 | 0.5 | – | – | – | – | ||||||||||||||||||

| Other operating gain, net | (0.5 | ) | – | – | – | – | (0.5 | ) | ||||||||||||||||

| Adjusted EBITDA | $ | 22.3 | $ | 18.1 | $ | 1.4 | $ | 6.2 | $ | (0.7 | ) | $ | (2.8 | ) | ||||||||||

| Total IDT Corporation | Traditional Communica-tions | net2phone | NRS | Fintech | Corporate | |||||||||||||||||||

| Three Months Ended July 31, 2023 (4Q23) |

||||||||||||||||||||||||

| Net income attributable to IDT Corporation | $ | 8.0 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||

| Net income attributable to noncontrolling interests | 0.8 | |||||||||||||||||||||||

| Net income | 8.8 | |||||||||||||||||||||||

| Provision for income taxes | 3.8 | |||||||||||||||||||||||

| Income before income taxes | 12.6 | |||||||||||||||||||||||

| Interest income, net | (1.1 | ) | ||||||||||||||||||||||

| Other expense, net | 0.5 | |||||||||||||||||||||||

| Income (loss) from operations | 12.0 | $ | 14.1 | $ | (0.7 | ) | $ | 1.7 | $ | (1.9 | ) | $ | (1.2 | ) | ||||||||||

| Depreciation and amortization | 5.1 | 2.3 | 1.5 | 0.7 | 0.7 | – | ||||||||||||||||||

| Severance | 0.5 | 0.4 | 0.1 | – | – | – | ||||||||||||||||||

| Other operating expense (gain), net | 0.5 | 1.8 | 0.1 | – | – | (1.4 | ) | |||||||||||||||||

| Adjusted EBITDA | $ | 18.1 | $ | 18.6 | $ | 0.9 | $ | 2.4 | $ | (1.2 | ) | $ | (2.6 | ) |

IDT Corporation

Reconciliation of Net Income to Adjusted EBITDA

(unaudited) in millions. Figures may not foot or cross-foot due to rounding to millions

| Total IDT Corporation | Traditional Communica-tions | net2phone | NRS | Fintech | Corporate | |||||||||||||||||||

| Three Months Ended April 30, 2023 (3Q23) |

||||||||||||||||||||||||

| Net income attributable to IDT Corporation | $ | 6.9 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||

| Net income attributable to noncontrolling interests | 0.9 | |||||||||||||||||||||||

| Net income | 7.7 | |||||||||||||||||||||||

| Provision for income taxes | 3.0 | |||||||||||||||||||||||

| Income before income taxes | 10.7 | |||||||||||||||||||||||

| Interest income, net | (0.7 | ) | ||||||||||||||||||||||

| Other expense, net | 0.4 | |||||||||||||||||||||||

| Income (loss) from operations | 10.4 | $ | 12.9 | $ | (0.4 | ) | $ | 2.1 | $ | (1.3 | ) | $ | (2.9 | ) | ||||||||||

| Depreciation and amortization | 5.2 | 2.5 | 1.4 | 0.6 | 0.7 | – | ||||||||||||||||||

| Severance | 0.1 | 0.1 | – | – | – | – | ||||||||||||||||||

| Other operating expense, net | 4.8 | 4.1 | – | – | – | 0.6 | ||||||||||||||||||

| Adjusted EBITDA | $ | 20.5 | $ | 19.7 | $ | 1.0 | $ | 2.7 | $ | (0.6 | ) | $ | (2.3 | ) | ||||||||||

| Total IDT Corporation | Traditional Communica-tions | net2phone | NRS | Fintech | Corporate | |||||||||||||||||||

| Three Months Ended January 31, 2023 (2Q23) |

||||||||||||||||||||||||

| Net income attributable to IDT Corporation | $ | 14.6 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||

| Net income attributable to noncontrolling interests | 0.7 | |||||||||||||||||||||||

| Net income | 15.3 | |||||||||||||||||||||||

| Provision for income taxes | 5.3 | |||||||||||||||||||||||

| Income before income taxes | 20.6 | |||||||||||||||||||||||

| Interest income, net | (0.8 | ) | ||||||||||||||||||||||

| Other income, net | (1.6 | ) | ||||||||||||||||||||||

| Income (loss) from operations | 18.2 | $ | 17.0 | $ | (0.6 | ) | $ | 5.4 | $ | (0.8 | ) | $ | (2.8 | ) | ||||||||||

| Depreciation and amortization | 5.0 | 2.4 | 1.4 | 0.6 | 0.7 | – | ||||||||||||||||||

| Severance | 0.2 | 0.2 | – | – | – | – | ||||||||||||||||||

| Other operating (gain) expense, net | – | – | – | – | (0.3 | ) | 0.3 | |||||||||||||||||

| Adjusted EBITDA | $ | 23.4 | $ | 19.6 | $ | 0.8 | $ | 6.0 | $ | (0.5 | ) | $ | (2.5 | ) | ||||||||||

IDT Corporation

Reconciliation of Earnings per share to Non-GAAP EPS

(unaudited) in millions, except per share data. Figures may not foot due to rounding to millions.

| 2Q24 | 1Q24 | 4Q23 | 3Q23 | 2Q23 | ||||||||||||||||

| Net income attributable to IDT Corporation | $ | 14.4 | $ | 7.7 | $ | 8.0 | $ | 6.9 | $ | 14.6 | ||||||||||

| Adjustments (add) subtract: | ||||||||||||||||||||

| Stock-based compensation | (2.5 | ) | (0.8 | ) | (1.0 | ) | (1.7 | ) | (1.3 | ) | ||||||||||

| Severance expense | (0.3 | ) | (0.5 | ) | (0.5 | ) | (0.1 | ) | (0.2 | ) | ||||||||||

| Other operating (expense) gain, net | (0.3 | ) | 0.5 | (0.5 | ) | (4.8 | ) | – | ||||||||||||

| Total adjustments | (3.1 | ) | (0.8 | ) | (2.0 | ) | (6.6 | ) | (1.5 | ) | ||||||||||

| Income tax effect of total adjustments | (0.6 | ) | (0.3 | ) | (0.7 | ) | (1.8 | ) | (0.4 | ) | ||||||||||

| 2.5 | 0.5 | 1.3 | 4.8 | 1.1 | ||||||||||||||||

| Non-GAAP net income | $ | 16.9 | $ | 8.2 | $ | 9.3 | $ | 11.7 | $ | 15.7 | ||||||||||

| Earnings per share: | ||||||||||||||||||||

| Basic | $ | 0.57 | $ | 0.30 | $ | 0.31 | $ | 0.27 | $ | 0.57 | ||||||||||

| Total adjustments | 0.10 | 0.03 | 0.06 | 0.19 | 0.05 | |||||||||||||||

| Non-GAAP – basic | $ | 0.67 | $ | 0.33 | $ | 0.37 | $ | 0.46 | $ | 0.62 | ||||||||||

| Weighted-average number of shares used in calculation of basic earnings per share | 25.2 | 25.2 | 25.4 | 25.5 | 25.5 | |||||||||||||||

| Diluted | $ | 0.57 | $ | 0.30 | $ | 0.31 | $ | 0.27 | $ | 0.57 | ||||||||||

| Total adjustments | 0.10 | 0.02 | 0.05 | 0.19 | 0.05 | |||||||||||||||

| Non-GAAP – diluted | $ | 0.67 | $ | 0.32 | $ | 0.36 | $ | 0.46 | $ | 0.62 | ||||||||||

| Weighted-average number of shares used in calculation of diluted earnings per share | 25.3 | 25.3 | 25.5 | 25.6 | 25.5 |

**Explanation of Key Performance Metrics

NRS’ recurring revenue is NRS’ revenue in accordance with GAAP excluding revenue from POS terminal sales. NRS’ Monthly Average Recurring Revenue per Terminal is a financial metric. Monthly Average Recurring Revenue per Terminal is calculated by dividing NRS’ recurring revenue by the average number of active POS terminals during the period. The average number of active POS terminals is calculated by adding the beginning and ending number of active POS terminals during the period and dividing by two. NRS’ recurring revenue divided by the average number of active POS terminals is divided by three when the period is a fiscal quarter. Recurring revenue and Monthly Average Recurring Revenue per Terminal are useful for comparisons of NRS’ revenue and revenue per customer to prior periods and to competitors and others in the market, as well as for forecasting future revenue from the customer base.

net2phone’s subscription revenue is its revenue in accordance with GAAP excluding its equipment revenue and revenue generated by a legacy SIP trunking offering in Brazil. net2phone’s cloud communications and contact center offerings are priced on a per-seat basis, with customers paying based on the number of users in their organization. The number of seats served and subscription revenue trends and comparisons between periods are used in the analysis of net2phone’s revenues and direct cost of revenues and are strong indications of the top-line growth and performance of the business.

BOSS Money’s Average Revenue per Transaction is also a financial metric. Average Revenue per Transaction is calculated by dividing BOSS Money’s revenue in accordance with GAAP by the number of transactions during the period. Average Revenue per Transaction is useful for comparisons of BOSS Money’s revenue per transaction to prior periods and to competitors and others in the market, as well as for forecasting future revenue based on transaction trends.

# # #